Fidelity's Kaleidoscope

Equity allocation in an era of geoeconomic fragmentation

Download this article in flyer formatEröffnen Sie zunächst ein FondsdepotPlus. Danach können Sie aus unseren Fonds und ETFs Ihre Favoriten wählen.

Melden Sie sich in Ihrem Depot an, um Fondsanteile zu ordern oder Ihren Sparplan anzulegen oder anzupassen.

Fidelity’s Kaleidoscope series

Amid US-centric equity positioning, diverging trends between regions are creating a more level playing field for equities globally.

President Trump was re-elected on a platform that links trade deficits to adverse socioeconomic outcomes, through the offshoring of jobs to foreign jurisdictions, with protectionist trade policies his solution. He also campaigned on a pledge to reduce the government’s fiscal deficit to restrain inflation and allow tax cuts, but it now appears that US debt issuance will instead accelerate as cost-cutting initiatives have proven more difficult than expected.

These developments present a quandary for investors. Protectionist trade policy is causing economic disruption, while fiscal stimulus could become negative for equity valuations through the channel of Treasury market dislocation if debt sustainability concerns intensify. Shifting currency dynamics must also be addressed given the **US’s high weightings in global indices and the dollar’s **elevated real effective exchange rate.

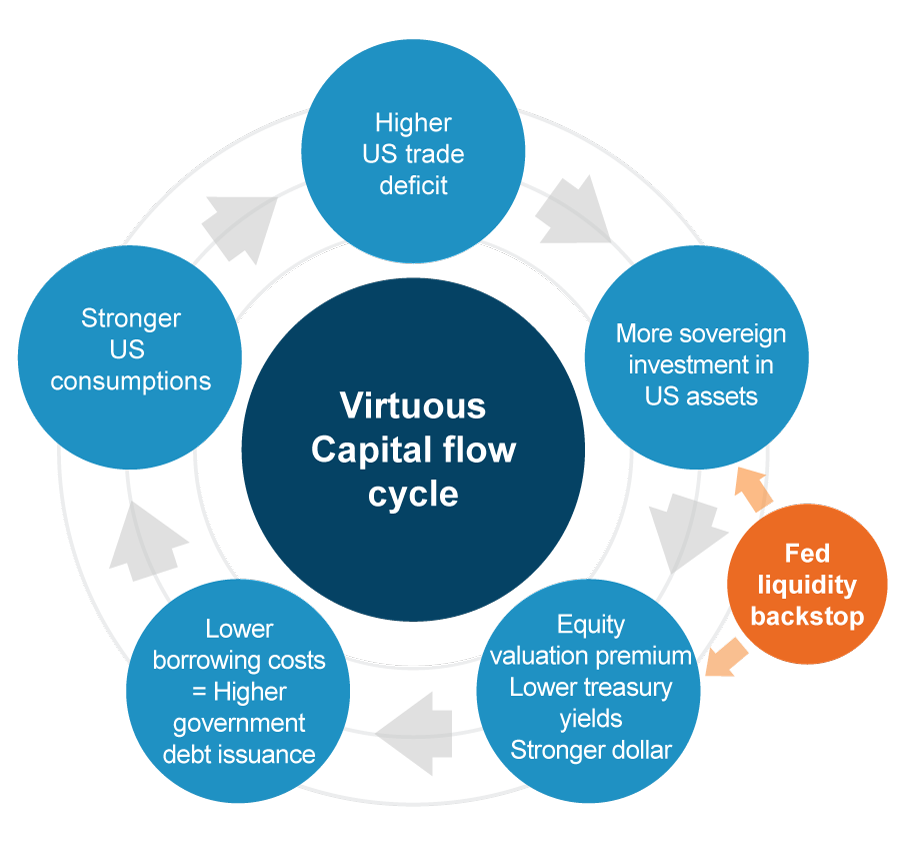

US assets have long benefitted from virtuous feedback loops associated with the country’s twin deficits (Figure 1). These have been predicated on the resilience of the US economy, strength of its corporates, globalist policy approach of its government, and the dollar’s reserve currency status. However, emerging challenges against these key pillars hold the potential to reorientate global capital flows and challenge the narrative of US exceptionalism - at least from a capital market perspective.

We are already seeing downward pressure on the dollar, while higher inflation expectations are affecting the Fed’s willingness to act as a liquidity backstop. In turn, term premia and US borrowing costs have increased. These dynamics could spur a vicious cycle if higher interest expenses result in the government debt burden expanding faster than the economy can grow.

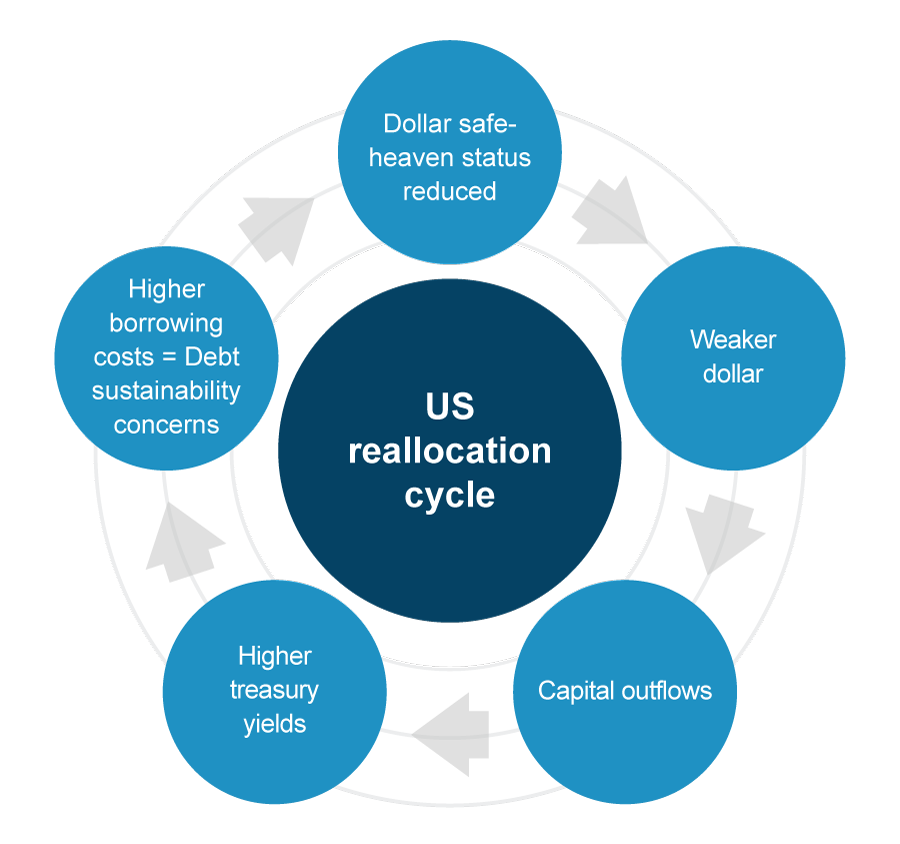

There is also potential for further weakening of the dollar to intensify headwinds against US assets. Amid resilient earnings, US equities have continued to attract near record inflows in 2025, despite the dollar’s decline. However, US earnings growth trends are now converging with those across large parts of Europe and Asia, creating a more level playing field for equities globally. We therefore see potential for a shift away from current US-centric positioning as aspects of US exceptionalism fade (Figure 2).

Source: Fidelity International, June 2025.

Equity valuations have, on average, increased through the post-1990 era, partly because of structurally lower macroeconomic risk and real interest rates. US valuations have risen most steeply, largely due to superior microeconomic fundamentals. However, these dynamics have introduced multiple layers of concentration risk to portfolios, especially for non-US investors.

The US now represents an outsized proportion of global equity market capitalisation, with current concentration levels exceeding even more extreme historical periods (Figure 3). At the same time, company-level concentration has also risen to multi-decade highs, partly because valuations having become elevated at the mega-cap end of the spectrum (Figure 4). This raises two distinct but interlinked concentration risks - that US corporates fail to outperform their peers from other regions, or that the US megacaps fail to justify their high valuations (perhaps due to earnings disappointment or a reassessment of equity risk premia).

| Figure 3: US dominates global equities | Figure 4: US megacaps’ elevated valuations |

|---|---|

For illustrative purposes only. Past performance is not an indication of future results.Source: Fidelity International, July 2025.

A more level playing field for equities globally means that US-centric equity positioning is less justified than it has been in the past, even if the US remains an attractive investment destination from a bottom-up perspective. Investors should therefore be considering their **geographic equity allocations.

While we continue to expect see **attractive long-term return potential for equities globally, market pricing suggests that alpha could become a more important component of overall returns. Ex-US valuation discounts have become more attractive, particularly given constructive macroeconomic developments across Europe and Asia, and especially for risk-aware global investors given the additional consideration of evolving currency dynamics.

A more discerning, differentiated approach to equity investing is therefore warranted, rather than broad passive exposure (Figure 5). However, those undertaking geographic allocation rebalancings must also consider the tracking-error implications of diverging from US-centric global indices.

Strategies that seek exposure to specific return drivers across or within regions, such as income, quality, or value.

Selective active exposure to companies benefitting from global trends like supply-chain realignment or technological innovation.

Strategies which seek asymmetric risk-adjusted return opportunities derived from shifting macro or micro dynamics.

Source: Fidelity International, July 2025.

In Europe, higher fiscal spending and growth boost earnings, offering opportunities in valued firms. Active, research-led strategies focusing on quality and income are validated.

US smaller firms offer faster growth and attractive value, with opportunities in domestic-focused companies benefiting from recent policy changes, requiring a bottom-up approach.

A flexible, value-driven approach using bottom-up research leverages tech trends while avoiding risks from high valuations in parts of the global tech sector.

*More information in German language.

** You are now leaving Globale Anlagelösungen | Fidelity International | Deutschland and will be redirected to another Fidelity website which is not affiliated with Fidelity in Germany. Fidelity in Germany was not involved in the creation of the content of this other website and accepts no responsibility or liability for its content.

Equity allocation in an era of geoeconomic fragmentation

Download this article in flyer formatImportant information

This material is for Institutional Investors and Investment Professionals only and should not be distributed to the general public or be relied upon by private investors.

This material is provided for information purposes only and is intended only for the person or entity to which it is sent. It must not be reproduced or circulated to any other party without prior permission of Fidelity.

This material does not constitute a distribution, an offer or solicitation to engage the investment management services of Fidelity, or an offer to buy or sell or the solicitation of any offer to buy or sell any securities in any jurisdiction or country where such distribution or offer is not authorised or would be contrary to local laws or regulations. Fidelity makes no representations that the contents are appropriate for use in all locations or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries or by all investors or counterparties.

This communication is not directed at and must not be acted on by persons inside the United States. All persons and entities accessing the information do so on their own initiative and are responsible for compliance with applicable local laws and regulations and should consult their professional advisers. This material may contain materials from third parties which are supplied by companies that are not affiliated with any Fidelity entity (Third-Party Content). Fidelity has not been involved in the preparation, adoption or editing of such third-party materials and does not explicitly or implicitly endorse or approve such content. Fidelity International is not responsible for any errors or omissions relating to specific information provided by third parties.

Fidelity International refers to the group of companies which form the global investment management organization that provides products and services in designated jurisdictions outside of North America. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances, other than when specifically stipulated by an appropriately authorised firm, in a formal communication with the client.

MK17091